Crypto Products See Inflows For Fourth Week As Bitcoin Dominates, Ethereum Struggles

Crypto investment products recorded inflows for a fourth consecutive week with Bitcoin leading the way amid heightened optimism over the approval of spot Bitcoin exchange-traded funds (ETFs).

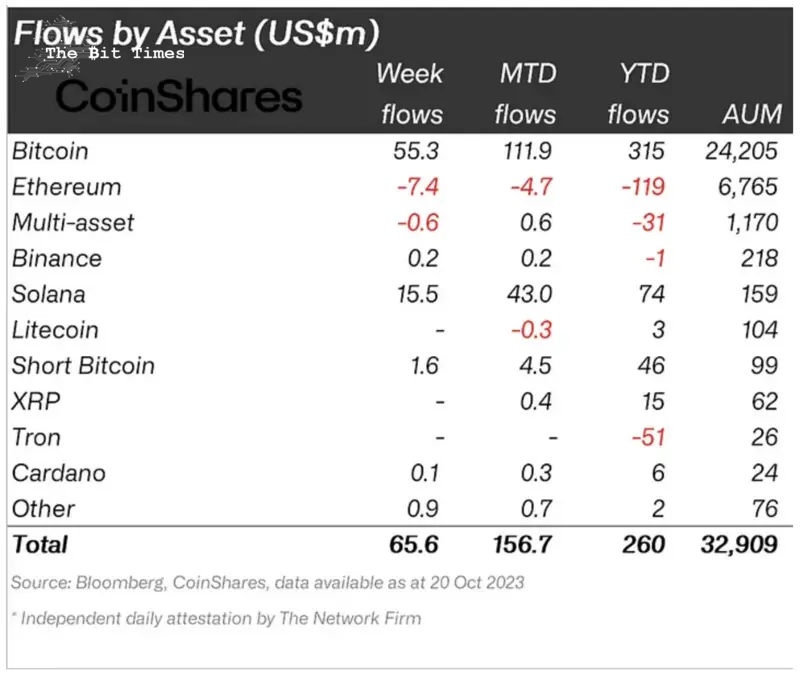

Inflows last week reached $66 million as assets under management rose 15% from their early September lows to reach $33 billion, the highest since mid-August, said CoinShares’ Digital Asset Fund Flows Weekly Report released on Oct. 23.

It seems that the anticipation of a spot #Bitcoin ETF has prompted further inflows for the 4th consecutive week. Here is our analysis with @Jbutterfill.

🟢 Week 43 inflows: US$66m

🔎 Inflows are relatively low in comparison to June’s @BlackRock announcements, suggesting more… pic.twitter.com/6AkDGQJVOh

— CoinShares (@CoinSharesCo) October 23, 2023

The inflows were still lower than in June, when BlackRock announced its spot Bitcoin ETF application, indicating a more cautious approach from investors this time around, CoinShares said.

Source: CoinShares

Bitcoin Accounted For 84% Of Inflows

Bitcoin dominated inflows with $55.3 million, or 84% of the total, pushing year-to-date Bitcoin product inflows to $315 million.

While the beginning of last week saw short-Bitcoin inflows at $23m, positions were pared back substantially, with net inflows by the end of the week at just $1.7m, suggesting short sellers are losing confidence, it said.

Solana (SOL) sucked in $15.5 million but Ethereum saw outflows of $7.4 million, the only altcoin to suffer outflows last week, CoinShares said.

Solana’s inflows brought its year-to-date total to $47 million, making it the most popular altcoin, said head of research James Butterfill.

BREAKING: 🇺🇸 US Court of Appeals orders SEC to review Grayscale's spot #Bitcoin ETF application. pic.twitter.com/RiyHU8Mpcp

— Bitcoin Archive (@BTC_Archive) October 23, 2023

Related News

- Lawyer Jeremy Hogan Says SEC Case Against Ripple, XRP Is Effectively ”Over”

- Binance UK Chief Joins Executive Exodus From Beleaguered Crypto Exchange

- Cathie Wood’s Ark Invest Offloads $5.8 Million Coinbase And GBTC Shares Even As Bitcoin Soars

Comments

Post a Comment