Why is Bitcoin considered "outside money?"

Bitcoin [BTC] started out as a means of payment, but with time, it is becoming a store of value. While the asset has become more mainstream its utility continues to get questioned. Some call it digital gold for its similarities with the latter. Regulators continue to remain in a haze if they should regulate the asset under securities, commodities, or currency. The true identity of the asset is often challenged. However, the term “outside money” has now entered the frame.

Inside Money v. Outside Money

Earlier this year, Zoltan Pozsar, a former Federal Reserve and U.S. Treasury Department official who is currently at Credit Suisse brought to light the terms “inside money” and “outside money.” Inside money is often referred to as fiat. Outside money on the other hand is basically “non-sovereign currencies.”

Earlier this year, Pozsar noted how a new global monetary order was emerging as a result of the commodity crisis in the United States, which will eventually weaken the dollar-based system and increase inflation in the West. Comparing the Ukraine war to World War II, Pozsar wrote,

“This crisis is not like anything we have seen since President [Richard] Nixon took the U.S. dollar off gold in 1971.”

The Bretton Woods pact, which was negotiated by 44 nations as World War II came to an end, set gold as the foundation for the U.S. dollar and tied other currencies to it. As the United States trade deficit grew too large to overlook, this framework started to deteriorate in the 1960s, and when the country abandoned the dollar’s peg to gold in 1971, it completely collapsed.

Following this, Bretton Woods II which is [1971-present] was backed by inside money or U.S. government paper. The ongoing monetary regime will reportedly end and Bretton Woods III is expected to occur after the Russia-Ukraine war. He said,

“After this war is over, ‘money’ will never be the same again…and bitcoin [if it still exists then] will probably benefit from all this.”

Deglobalization trends, domestic supply networks, and commodity reserves would all result in prolonged inflation, as per Zoltan. Nations outside of the U.S. and EU alliance would “inevitably, although not imminently” turn to external reserves like gold and other commodities. Additionally, G7 “inside money” and foreign exchange reserves would gradually depreciate in value.

Bitcoin is “big and powerful” now, says Messari

Bitcoin’s utility as an inflation hedge was contested this year due to the gruesome bear market. A recent report by Messari addresses the same. The report read,

“Bitcoiners often get ridiculed for “moving the goal posts” on bitcoin as an inflation hedge, but most of us have always used inflation as shorthand for “long-term monetary debasement” [QE is permanent], not point-in-time hedges on changes to Fed rate policy [target interest rates are temporary and subject to rapid adjustments].”

The report also pointed out how Bitcoin has become “big” now. Messari further highlighted how BTC’s ascendance would be slow yet powerful. This notion was emphasized by several individuals.

Is BTC the ultimate form of outside money?

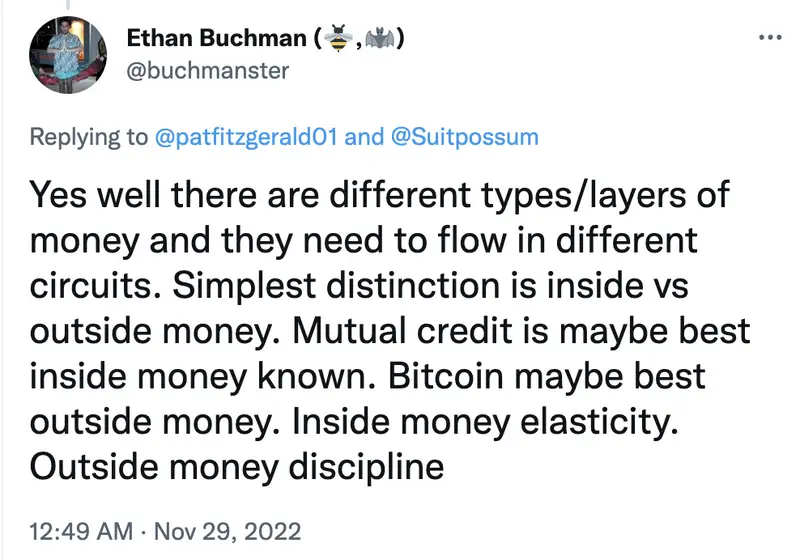

Crypto Twitter certainly thinks so. Over the year, several have pointed out that BTC is the only outside money that could be settled immediately across the globe.

Additionally, several continue to call out the asset for its performance this year. Even though Bitcoin has recorded a 75 percent drop throughout the year, it should be noted that the asset certainly has a higher purpose to serve.

Comments

Post a Comment